Is Your Business Line of Credit Hurting Your Personal Credit? What Lenders Keep Hidden

Your company could be quietly damaging your personal finances, and you might not even realize it. A staggering 73% of small business owners lack knowledge of how their business credit decisions influence their personal finances, potentially costing them thousands in higher interest rates and rejected credit applications.

So, does a business line of credit affect your personal credit? Let’s explore this vital question that could be quietly shaping your financial future.

Do Lenders Check Your Personal Credit for a Business Line of Credit?

When you apply for a business line of credit, will lenders examine your personal credit score? Absolutely. For small businesses and new ventures, lenders nearly universally perform a personal credit check, even for company loans.

This initial inquiry triggers a “hard pull” on your credit report, which can briefly reduce your personal score by 5-10 points. Several inquiries in a limited window can compound this effect, indicating potential credit risk to creditors. As you apply repeatedly, the greater the negative impact on your personal credit.

How Does an Approved Business Line of Credit Affect You?

After securing your business credit line, the scenario gets complicated. The effect on your personal credit relies heavily on how the business line of credit is structured:

For sole proprietorships and individually secured business credit lines, your repayment record typically reports on personal credit bureaus. Delinquent accounts or non-payments can severely harm your personal score, sometimes reducing it significantly for serious delinquencies.

For formally established LLCs with business credit lines without personal guarantees, the activity is often distinct from your personal credit. Yet, these are increasingly rare for new companies, as lenders frequently insist on personal guarantees.

Protecting Your Personal Score While Accessing Business Credit

How do you shield your personal finances while still accessing company loans? Follow these tips to limit negative impacts:

Establish Clear Separation Between Personal and Business Finances

Establish a formal business entity rather than operating as a sole proprietorship. Keep strict separation between personal and business accounts to protect your credit.

Develop Robust Corporate Credit Independently

Secure a DUNS identifier, establish trade lines with suppliers who report to business credit bureaus, and maintain perfect payment history on these accounts. Solid company creditworthiness can minimize the need on personal guarantees.

Opt for Pre-Approval with Soft Checks

Work with lenders who offer “soft pull” prequalifications before submitting full applications. This minimizes hard inquiries on your personal credit, safeguarding your score.

Dealing with a Credit Line That’s Hurting Your Credit

What if you already have a business line of credit impacting your personal score? Take proactive steps to lessen the damage:

Seek Business Bureau Reporting

Contact your lender and inquire that they report activity to business credit bureaus instead get more info of personal ones. Certain creditors may comply with this change, particularly when you’ve demonstrated reliable payment history.

Explore Alternative Financing

After building robust corporate credit, look into switching to a lender who avoids personal credit reporting.

Is It Possible for Business Credit to Help Your Personal Score?

Remarkably, it’s possible. When used correctly, a personally guaranteed business line of credit with consistent on-time payments can enhance your credit profile and show creditworthiness. This can potentially boost your personal score by up to 30 points over time.

The key is utilization. Ensure your credit line usage stays under 30% to optimize credit benefits, just as you would with consumer credit.

What Else You Need to Know About Business Credit

Understanding the impact of business financing extends beyond just lines of credit. Corporate financing can also influence your personal credit, often in ways you might not expect. For example, Small Business Administration loans come with undisclosed challenges that 82% of entrepreneurs don’t discover until it’s too late. These can include personal guarantees that tie your personal score to the loan’s performance, potentially resulting in lasting harm if payments are missed.

To stay ahead, learn more about how all types of loans interact with your personal credit. Consult with a financial advisor to navigate these complexities, and frequently review both your personal and business credit reports to catch issues early.

Secure Your Credit Today

Your business must not undermine your personal credit. By knowing the consequences and taking proactive steps, you can access the financing you need while preserving your personal financial health. Start today by reviewing your current credit lines and implementing the strategies outlined to minimize risks. Your economic stability depends on it.

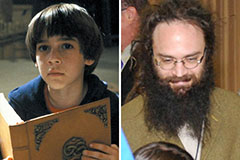

Angus T. Jones Then & Now!

Angus T. Jones Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Molly Ringwald Then & Now!

Molly Ringwald Then & Now! Macaulay Culkin Then & Now!

Macaulay Culkin Then & Now! Peter Billingsley Then & Now!

Peter Billingsley Then & Now!